Veröffentlichung eines neuen Artikels “On the influence of conventional and automated market makers on market quality in cryptoeconomic systems” in Electronic Markets

(14.08.2024) Daniel Kirste, Alexander Poddey, Niclas Kannengießer, und Ali Sunyaev veröffentlichten ihren neuen Beitrag “On the influence of conventional and automated market makers on market quality in cryptoeconomic systems” im Journal Electronic Markets.

Abstract:

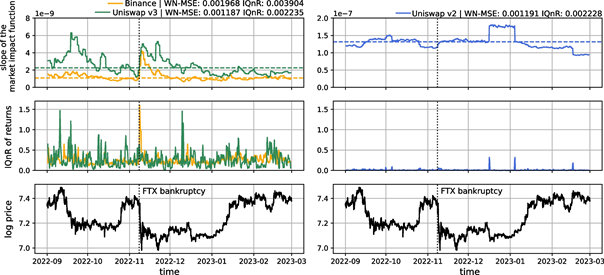

Decentralized exchanges (DEXs) have become an alternative to centralized exchanges (CEXs) for trading assets in the form of tokens in cryptoeconomic system markets. The emergence of DEXs is strongly driven by their potential to tackle challenges for market quality originating from CEXs by design, such as opaque market-making strategies and centralization of power. However, it remains unclear to what extent DEXs can enhance market quality compared to CEXs. A core reason for this is the lack of an analysis concept for investigating influences of market makers, including automated market makers (AMMs) used in DEXs and conventional market makers used in CEXs, on market quality in cryptoeconomic systems. To better understand influences of market makers on market quality in cryptoeconomic systems, we developed an analysis concept based on our formal price model grounded in established concepts of market microstructure. We demonstrate the usefulness of the analysis concept by examining conventional market makers on CEXs (i.e., Binance and Coinbase) and automated market makers (AMMs) on DEXs (i.e., Uniswap v2 and Uniswap v3). The main purpose of this work is to support the analysis of influences of different market makers on market quality in cryptoeconomic systems. This is useful to better understand how cryptoeconomic systems can ensure high market quality and safeguard market participants, when issuing tokens.

Link zur Publikation: https://doi.org/10.1007/s12525-024-00723-1