New Article „ HybCBDC: A Design for Central Bank Digital Currency Systems Enabling Digital Cash “ Published in IEEE Access

(12.09.2024) Ricky Lamberty, Daniel Kirste, Niclas Kannengießer, and Ali Sunyaev published a new article titled “HybCBDC: A Design for Central Bank Digital Currency Systems Enabling Digital Cash” in IEEE Access.

Abstract:

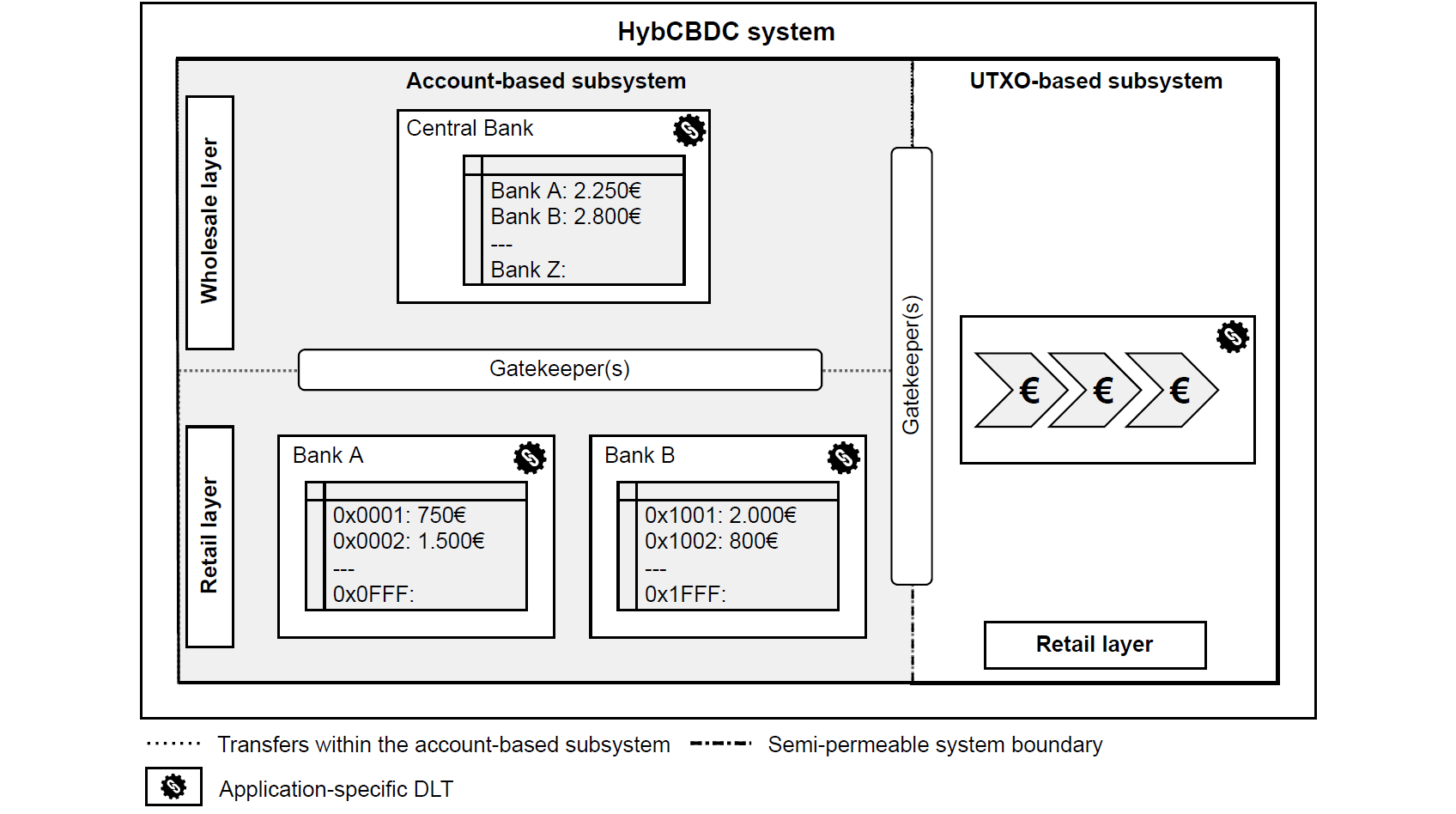

Central Bank Digital Currencies (CBDCs) have the potential to increase the financial reliability of digital payment systems by offering direct interactions between payment system participants, including institutional and private ones. To unfold the potential of CBDCs, CBDC systems need to offer confidential payments to protect participants from surveillance. However, confidential payments lay at odds with requirements for transparency of payments in CBDC systems to enforce regulations, such as anti-money laundering (AML) and countering the financing of terrorism (CFT) regulations. This work presents HybCBDC, a CBDC system design that tackles the tension between confidential payments and the enforceability of regulations. We iteratively refined HybCBDC in three rounds of focus group interviews with finance and industry experts. HybCBDC offers cash-like confidential payments and means to enforce regulations. HybCBDC builds on a hybrid access model for using monetary items of a CBDC and combines an account-based and an unspent transaction output (UTXO)-based subsystem to record payments. The main purpose of this work is to support the design of CBDC systems that can tackle the tension between offering payments with cash-like confidentiality while allowing for enforcement of regulations related to AML and CFT.

R. Lamberty, D. Kirste, N. Kannengießer and A. Sunyaev, "HybCBDC: A Design for Central Bank Digital Currency Systems Enabling Digital Cash," in IEEE Access, doi: 10.1109/ACCESS.2024.3458451

Link to Publication: https://ieeexplore.ieee.org/document/10676960